The following article was sourced from SHRM.org

Thanks in part to persistent high inflation, employees will be able to sock away a lot more money in their health savings accounts (HSAs) next year.

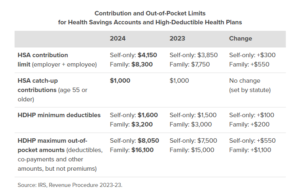

Annual HSA contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the IRS announced May 16: The annual limit on HSA contributions for self-only coverage will be $4,150, a 7.8 percent increase from the $3,850 limit in 2023. For family coverage, the HSA contribution limit jumps to $8,300, up 7.1 percent from $7,750 in 2023.

Participants 55 and older can contribute an extra $1,000 to their HSAs. This amount will remain unchanged.

Meanwhile, for 2024, a high-deductible health plan (HDHP) must have a deductible of at least $1,600 for self-only coverage, up from $1,500 in 2023, or $3,200 for family coverage, up from $3,000, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,050 for self-only coverage in 2024, up from $7,500 in 2023, or $16,100 for family coverage, up from $15,000.

The IRS also announced it will raise the maximum amount that employers may contribute to an excepted-benefit health reimbursement arrangement (HRA) in 2024 to $2,100—up from the 2023 amount of $1,950.

The increases are detailed in IRS Revenue Procedure 2023-23 and take effect in January 2024.

The new limits are a significant jump, but they are not surprising in the context of months and months of rising inflation, which has contributed to growing costs for employees, said Kevin Robertson, senior vice president and chief revenue officer at HSA Bank.

“The increase to these limits is not surprising because it is indexed by the Chained Consumer Price Index by the IRS, and these limits are warranted by the inflationary impacts of the last year,” he said.

While expected, the increase in 2024 HSA limits is significant for passing certain symbolic financial thresholds, he said. For the first time, including catch-up contributions for those ages 55 and older, a couple on family coverage can now contribute more than $10,000 and a single person on self-only coverage can now contribute more than $5,000.

“These are important levels that can not only have strong subconscious impacts on HSA participants, but also may catch the attention of financial advisors who might be helping advise these people,” Robertson said. “This is very good news to help more Americans understand and use HSAs as a powerful tool in their health care spending and long-term savings.”

Many industry experts tout HSAs as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free.

HSA enrollment continues to grow, and more employers also are offering contributions to employees’ accounts. At the end of 2022, Americans held $104 billion in 35.5 million HSAs, according to HSA advisory firm Devenir.

Despite the benefits, most holders aren’t taking full advantage of their accounts and are missing out on substantial rewards, according to the Employee Benefit Research Institute. The average account holder has a modest balance, contributes far less than the maximum and does not invest their HSA, recent EBRI data found.

The HSA limits are released every April or May by the IRS—ahead of other limits such as flexible spending accounts and 401(k) contributions— giving employers and HSA administrators plenty of time to adjust their systems. Employers often promote HSAs and encourage employees to boost their contributions during open enrollment, though it would be a good idea for HR and benefits leaders to start that conversation now, Robertson said.

“For employers looking for ways to capture their employees’ attention on the advantages of HSAs, this is ‘good news to use’ to help promote healthy behavior and engagement with their employees,” he said. “This can be helpful in helping employees understand how to address not only their current health care spending but also, and more importantly, understand the impact HSAs can have on their long-term retirement preparation.”

Have questions? Want to learn more? Fill out the form below.