Section 79 of the Internal Revenue Code (IRC) requires that employers calculate imputed taxable income for employees that receive group life insurance coverage that exceeds $50,000.

The amount of imputed taxable income must be reported on an employee’s Form W-2. The IRC Section 79 allows employees to exclude up to $50,000 of coverage from taxable income.

The IRS requires that employees pay taxes on what is considered the value of group life insurance in excess of $50,000. For example, if an employee has $85,000 of group life insurance coverage, paid for by their employer, the employer must calculate the value of this benefit to the employee.

The excess coverage would be $35,000 (85,000 – 50,000). This does not mean an employee will pay taxes on an additional $35,000 of taxable income. It means the employee will pay taxes on the value of the $35,000 group life benefit.

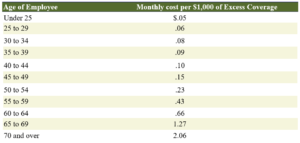

Employers should use the following table as prescribed by the Internal Revenue Service. When using this table and calculating the imputed taxable income, it is important to note that you must use the age of the employee as of the last day of the calendar year.

Want to learn more? Need to get in touch? Fill out the form below.