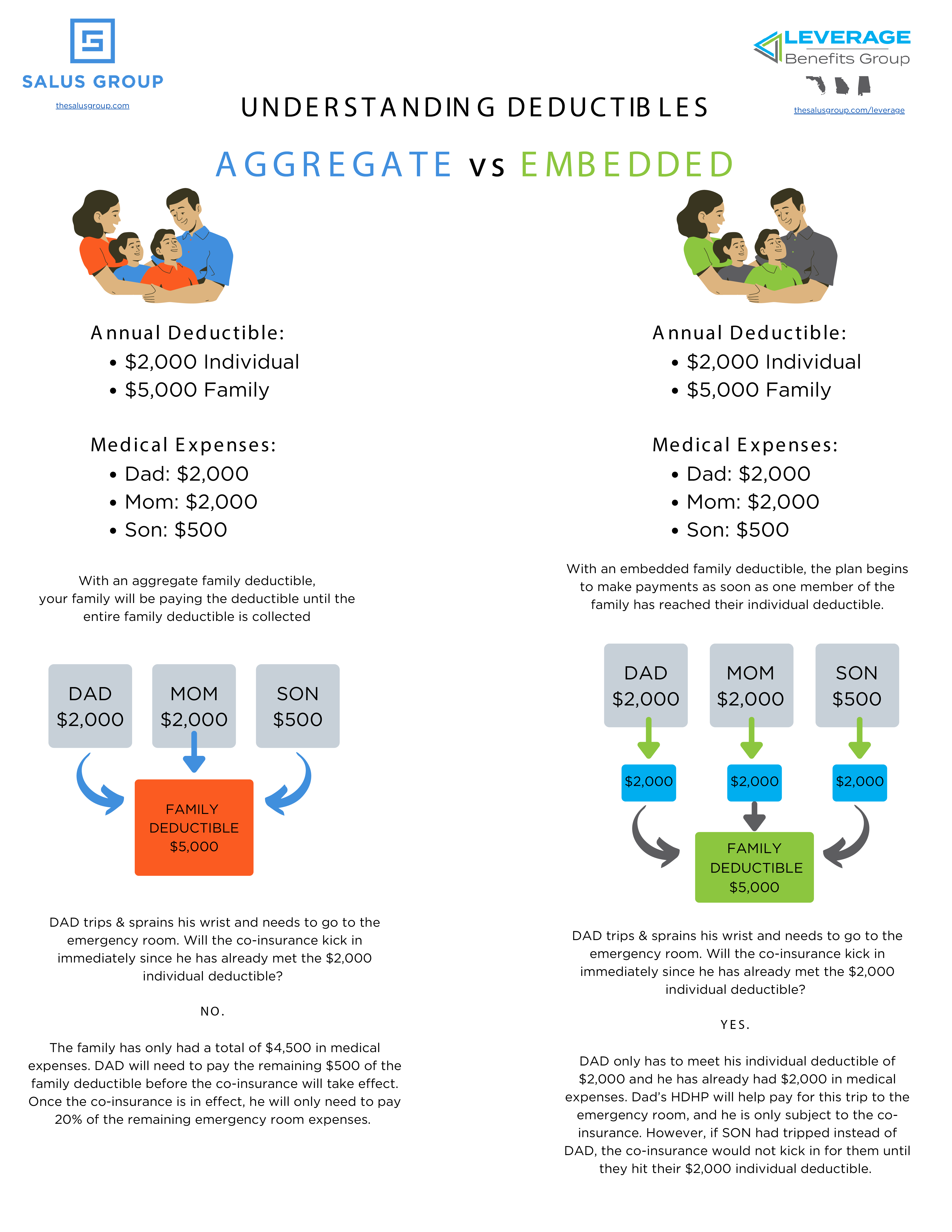

Aggregate deductibles apply in Family Plans. With an aggregate family deductible, the health plan doesn’t begin paying for the post-deductible healthcare expenses of anyone in the family until the entire family deductible has been met. Once the aggregate family deductible has been met, health insurance coverage kicks in for the entire family.

For example, pretend you have a plan which features an in-network family deductible of $5,000; if one member of the family has a claim that costs $2,500, the Carrier will NOT pay at the co-insurance point until the full $5,000 has been met. This $5,000 can be met with a combination of any member(s) on the plan.

How does an Aggregate Deductible Work?

There are two ways the aggregate deductible can be met:

To Summarize:

An aggregate deductible is the family’s total deductible. This means a single family member or the family as a whole does have to meet the full family plan deductible before his or her health insurance payments kick in.

Sources:

Verywelhealth.com